RESERVE BANK OF AUSTRALIA (RBA) CUTS INTEREST RATES TO HISTORIC LOW

The official interest rate has been cut yet again by the RBA to a new record low of 0.75%. The cut of 0.25% follows similar an earlier cut in July. RBA Governor Philip Lowe highlighted the following points in his post-meeting statement:

- The decision was made to ‘support employment and income growth and to provide greater confidence that inflation will be consistent with the medium-term target. The economy still has spare capacity and lower interest rates will help make inroads into that.’

- ‘Forward-looking indicators of labour demand indicate that employment growth is likely to slow from its recent fast rate.’

- ‘Interest rates are very low around the world and further monetary easing is widely expected, as central banks respond to the persistent downside risks to the global economy and subdued inflation.’

- ‘It is reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target. The Board will continue to monitor developments, including in the labour market, and is prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time.’

EOS MAKER BLOCK.ONE ORDERED BY SEC TO PAY U.S $24 MILLION

The Securities and Exchange Commission (SEC) announced on Monday the 30th of September that charges against EOS maker Block.One had been settled. Block.One must pay U.S $24 million in penalties for conduction an unregistered securities sale. The sale was in the form of an unregistered Initial Coin Offering (ICO). Block.One conducted an ICO between 2017 & 2018 in which it raised U.S $4.1 billion. The SEC also announced that Block.One has agreed to settle the charges. The fined amounts to only 0.0058% of the amount raised in the ICO.

QUANTUM QUBIT … QU-WHAAAAAT?

Is it just me, or is everyone else equal parts blown away and terrified of this?

News spread this week around leaked documents claiming that Googles 53-qubit quantum computer, named Sycamore, has successfully performed an extremely complex calculation in 200 seconds that would take a current and extremely advanced supercomputer 10,000 years.

Supposedly, Google had a little help, with collaboration from multiple parties including the likes of NASA. While it’s unlikely they have developed a fully functional machine; it could point towards a potential breakthrough being within arm’s reach. The Financial Times reported quoted the leaked paper which claimed to have achieved “quantum supremacy”. While this is unlikely, all is likely to be revealed once the completed paper is published in the not so distant future.

So, what is a Quantum computer exactly?

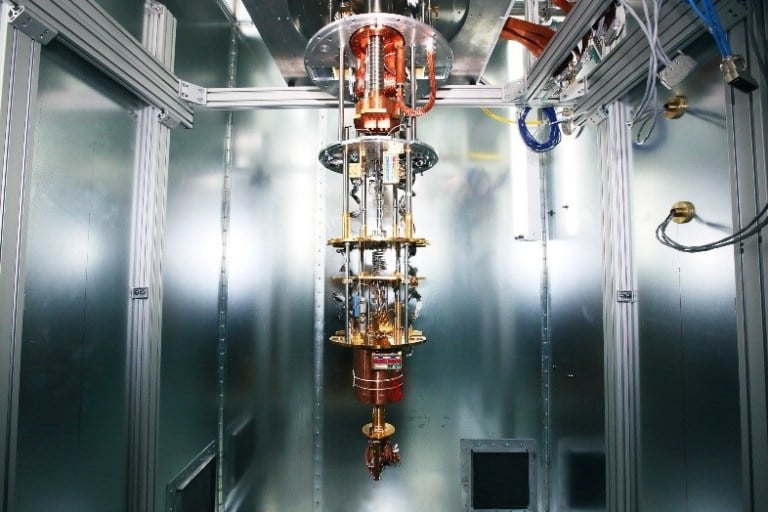

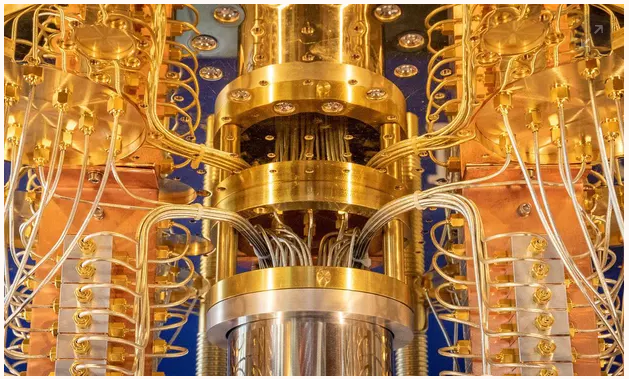

- First off, it’s unconventional looking compared to today’s supercomputers, as you can see in the images below. It reminds me of how they used to imagine the future in old Sci-fi movies – ever seen the original Star Trek series?

- They are temperamental and need very cold climates to run. They can be easily affected by their surrounds – things like noise and movement can swiftly cause the computer to fail.

- They run on quantum bits or “qubits”. In standard computing terms a ‘bit’ is a 1 or 0, and a computer will spit out its “answers” to problems as either 1 or 0. Whereas a qubit can be both a 1 and a 0. This is where the “QU” comes into play, it represents four states of thought/computation by the computer, they actually can all exist simultaneously. So, your code could be 00,01,10,11 instead of just 1 or 0. Basically what that boils down to, is that the machine is faster, much faster, than today’s super computers.

- A quantum computer exploits “…the properties of quantum mechanics, the science that governs how matter behaves on the atomic scale.” This is a state called Quantum Superposition. It’s been argued that because of this, they lack the ability to solve real-world problems but if Google have overcome this, it’s a global game-changer.

What do they look like? And note this is not taken from the Xmas edition of Doctor Who!

Googles Quantum Computer – Sycamore – Photograph: Kim Stallknecht/Reuters – sourced: HERE

IBMs 53-Qubit Quantum Computer – Photograph: Stephen Shankland/CNET – Source: HERE

How does quantum computing impact crypto and the world around us?

The leaked successful test states the existence of a 53 Qubit machine, the Bitcoin network is secured by Sha256 or 256-bit encryption. Basically, the quantum computer would need to be 256 Qubit minimum to crack the code or at least, pose a threat. Google has claimed this is possible, but not until the year 2022.

From a near-term perspective Cointelegraph reported ex-Bitcoin Core developer Peter Todd as stating:

“It means nothing because Google’s quantum breakthrough is for a primitive type of quantum computing that is nowhere near breaking cryptography … We still don’t even know if it’s possible to scale quantum computers; quite possible that adding qbits will have an exponential cost.”

The NSA has previously stated that they are developing a Quantum resistant cryptography, which would be required eventually, given the more concerning development could be that scientists at Google believe the computer’s power will more than double each year. Zerohedge reported

“At this rate, Google will be able to break all military encryption by 2024, a frightening prospect given the company’s close ties to China.”

So, while quantum computers are becoming more and more of a reality, practically speaking, they are still a ways off. One successful test is a positive step but still a far cry from a fully functioning machine that can continually reset and process transaction after transaction.

With each successful quantum test, we will undoubtedly continue to see contrasting announcements in the crypto space, like advancements in chains and security protocols, to combat these quantum developments. Cue hard forks a plenty!

I’ll leave you with this terrifying quote from Mike Adam’s article in Natural News;

“Google will rapidly come to dominate the world, controlling most of the money, all speech, all politics, most science and technology, most of the news media and all public officials … Google will become the dominant controlling authoritarian force on planet Earth, and all humans will be subservient to its demands. Democracy, truth and freedom will be annihilated.”

Helpful links and resources for further reading: Nanalyze, Zerohedge, Natural News, Wired, Rappler, TheHindu, The Guardian, The New Yorker, Cointelegraph

THE SILICON TOUCH

Sticking to the tech advancements theme, IEEE Spectrum reported many chipset developers such as AMD, Intel, NVIDIA and others are working on a new technology called Silicon-Interconnect Fabric.

While most manufacturers are already producing chiplets (sort of like a much smaller motherboard inside of advanced packaging, making for smaller phones, laptops and processors), the silicon fabric would break the existing mould and include the entire computer. Which basically means you could reduce the size of a server computer by 70% or reduce the size of space needed in a smartphone for the chipset by a factor of 10!

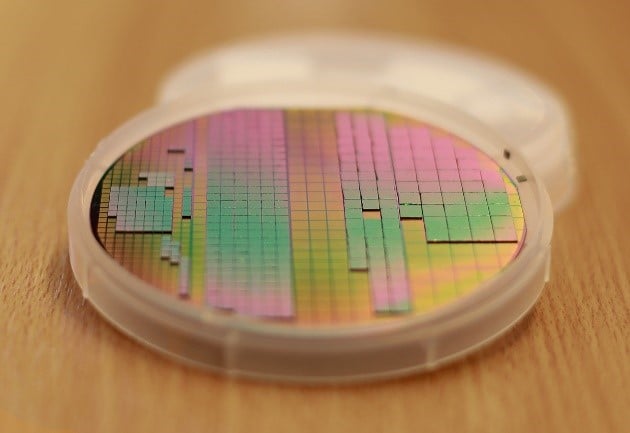

Here’s a prototype of how silicon fabric would look:

Courtesy of Spectrum – Photos: UCLA Chips Chiplets Ahoy! Test dielets, or chiplets, link up on a silicon-interconnect fabric built on a 100-millimeter-wide wafer. Unlike chips on a printed circuit board, the dielets can be placed a mere 100 micrometers apart, speeding signals and reducing energy consumption.

IKEA AN ENERGY EXAMPLE – BITCOINS REAL FOOTPRINT?

Reuters reported “IKEA will generate more renewable energy before the end of 2019 than the energy its stores use.” And engadget stated “The retailer expects to offer home solar panels in stores across all its markets in 2025. Ultimately, it plans to be climate-positive (reducing more emissions than it puts out) by 2030.” All of this has been achieved to date by a solar and wind investment of $2.8 billion USD. It’s an inspiring prospect, actually seeing one of the largest global companies backing up their climate statements with action. It hit home with me this week after a family member questioned me on Bitcoin and its impact on the world through excessive energy consumption. It got me thinking, what is the current Bitcoin energy footprint?

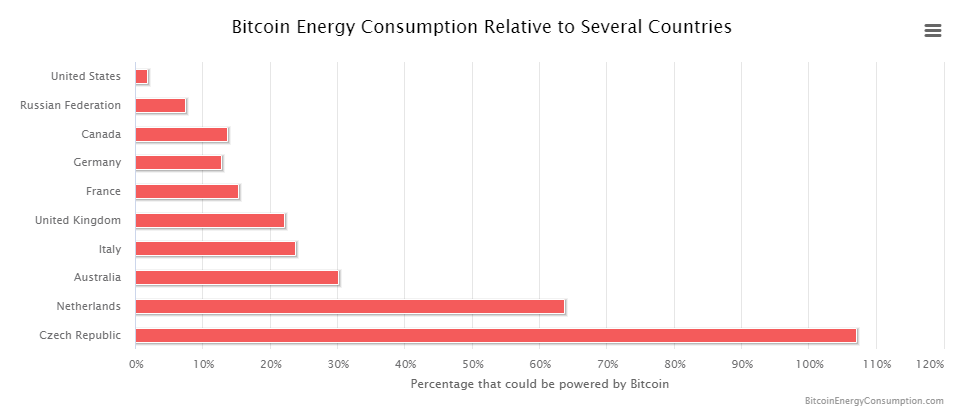

For the purposes of today, lets take 75TWh per year, this was a common number found across several sources (digiconomist, The Verge, Vox) and seems to fairly represent today’s Bitcoins energy consumption. Its comparable to the consumption of Czech Republic or Austria.

These numbers are significant, and until recently many believed it was majority dirty fossil fuel driven, however, a recent report by Coinshares outlines that Bitcoin gets 74.1% of its energy globally from renewables, solar, wind, hydro. Projects have been built in suitable locations like Iceland and mountainous areas in China, specifically for their proximity to renewables and the cold climate. Many are using energy that would otherwise have been grounded or wasted due to lack of demand. So yes, the power consumption is high, but it is designed, to be somewhat sustainable. Global warming however, is still affected by the heat these mining farms produce, and that in itself is a concern, I couldn’t find numbers on the heat created globally, but for anyone who has been near a Bitcoin miner, it is significant and in large densities could be a problem.

This brings us to the advancement of Bitcoin mining. Over the 10+ years Bitcoin has existed, the way its mined has moved from laptop and USB sticks to Graphics cards, and more recently onto standalone mining units known as ASICs. These units, whilst more power hungry than a household PC, produce much more hash to the network, and as a result provide a higher level of security. I bring this up because I feel it’s important to see the correlation of the development of mining in the space to the price of Bitcoin. At present 60-70% of Bitcoin mining revenue goes towards paying for power, that’s with Bitcoin around $10,000USD. If we see the future evolution of Bitcoin incorporating a higher price and a larger transaction base, we wouldn’t see an increase in power consumption, this remains static. $50,000USD Bitcoin, would see the power price be 12-15% as an example. In short, the longer the network exists, the more it will evolve, the better developed it will be and the more economical it becomes.

Let’s take Bitcoin vs Visa and the banking networks as an example of scaling.

It’s said that Visa completes around 150 million transactions each day, or 55 billion a year.

Bitcoin in comparison completes around 400,000 transactions each day, or 145 million a year.

Let’s put the Visa and banking network in perspective by putting some energy consumption numbers against it, in 2017 Hackernoon did this by breaking the banking system down into 3 components servers, branches and ATMs:

“Total consumption for banks during a year only on three metrics is around 26Twh on servers, 58Twh on branches and 13Twh on ATMs for a total of close to a 100 TWh a year.”

So conservatively the banking network is consuming 100TWh per year (2017) and Bitcoin around 75TWh (2019). Given 2 years ago the Bitcoin number was 25TWh, Bitcoin is growing and catching the banking network rapidly. It is a problem, and it does need to be addressed.

Possible solutions so Bitcoin can pull off an IKEA:

- Batch payments into one transaction

- Lightning Network – near instant transactions with no fees

- Alternative blockchains – proof of stake as an example

- Continued advancements in mining hardware and reduction in electrical consumption

Hopefully with more advancement in this space, we will see a reduction in electricity consumption through improved hardware, an increase in hashrate and network security. More transaction on the network, thus lowering the per transaction costs and several scalability advancements to aid in the growth of the overall network to see it catch up with the likes of Visa. I had hoped to end this article with a quick solution, but it really isn’t that simple. Hopefully by raising awareness in this space and everyone continuing to educate themselves we can become more informed and understand how the network looks and delivers into the future for a reduced carbon footprint.

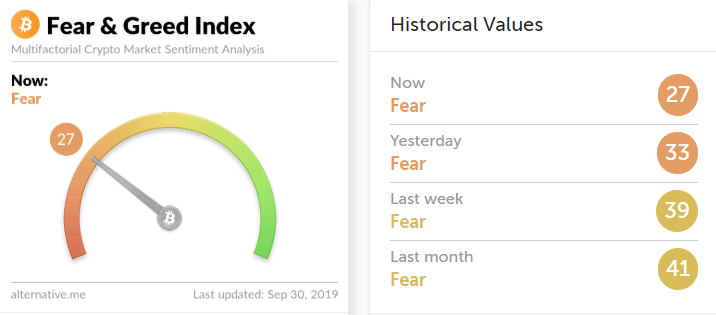

FEAR, GREED AND MENTALITY

The Alternative.me Fear and Greed index has experienced another week of fear attributed to the price declines in Bitcoin from $10,000USD to $8,000USD. I’ve noticed a fairly split community around the use of this index, and this week I saw on Crypto Zombie’s YouTube channel, the plotting of the index vs the price of Bitcoin. In the image below and found here at minute 11:30 he has mapped each time the index hit 7 – extremely fearful. 14 times in total, 3 are red, 2 are orange and the other 9 are green, effectively of the last 14 times the index hit 7 or lower had you bought, then you would have been correct 65% of the time and had a near instant increase in the price of Bitcoin vs purchase price. Even more interestingly, if you were using the dollar cost average (DCA) approach and only bought each time it hit this area and held, not traded, you would be up on all positions bar 3 (two most recent green bars and the third bar from the left (red in colour). All other entries would have equated to a long-term hold being profitable. For me that validates the usefulness of this indicator, especially as a DCA tool.

BITCOIN IRL & FUN

The Crypto Bubble bringing another hilarious instalment – “Liquidated” – check it out here

Read last week’s Mining Store Weekly Rundown

Author: Julian Carruthers

Not financial or investment advice, always do your own research.