BLOCKFI CHASING INSTITUTIONAL INVESTORS

BlockFi is a cryptocurrency lending start-up that raised $18.3 million USD in series A funding back in August of this year. Among the funding parties, contributions were made by Winklevoss capital, Galaxy Digital and Morgan Creek. BTCMANAGER reported this week, BlockFi is intending to launch Institutional Services, a new platform specifically designed for that space, targeting “…family offices, market-makers, funds, and bitcoin trading venues”. The new platform will offer enterprise-grade solutions to service blockchain cryptocurrency investments. It’s no surprise that the custodial services for the exchange will be held with Winklevoss-owned early-investors, Gemini.

BlockFi are quoted saying it “made sense” to announce and establish the platform in only one year since inception due to the growth they have been experiencing in the institutional space. As at March this year, BlockFi reportedly had more than 10,000 customer accounts holding interest-bearing crypto assets. This kind of growth and exposure in the cryptocurrency space is very healthy and goes to show that while the markets may have been choppy, institutional money continues to enter the space.

FED PRINTING BITCOIN MARKETCAP EQUIVALENT

When Bitcoin was sitting around $7.9K USD earlier this week, its market cap was sitting close to $140 billion. As reported by Bitcoinist, in just two days last week, the US Federal Reserve “…has continued its streak of quantitative easing, by pouring in funds to uphold the confidence that liquidity won’t dry out. The latest sum, $104 billion, is almost close to Bitcoin’s loss-adjusted market valuation.”

To fully understand the enormity of this action, let’s quickly discuss what the Repo market is. Bitcoinist sum it up nicely; “It is where the big banks borrow money overnight in exchange for low-risk collateral such as treasures and securities”. These are generally short-term loans paid back the next day, always at an interest rate and historically below the Fed’s interest rate. However, on September 17 this year something unusual happened; the Repo rate hit 10%. That is more than 4x the Fed’s usual rate and was driven by a huge shortage of liquidity in the pool. A spike like that could completely destabilise the entire financial system and bond market, as a result in came the Fed yet again and injected billions.

These kinds of actions serve as a strong reminder of just how volatile our global financial system is right now. Governments will continue to just print money out of thin air, constantly devaluing that currency, think of it like this, you are getting paid $x every week to work, but every week the government prints more cash so that $x reduces in value, slowly, slowly, every day indefinitely you are actually getting paid less because the government keeps printing money. In contrast, Bitcoin offers a truly sound asset investment alternative with strict inflationary guidelines. It’s decentralised and is completely free from government control. As with any investment of course, it isn’t immune to price swings as a result of Government legislation, but it is free of governmental control.

BINANCE PUTS CRED BEHIND ITS LENDING

Cred is a licensed California-based lending service enabling cryptocurrency wallet providers, custodians exchanges and others to offer the most competitive lending and borrowing rates in the industry. It was founded by two former PayPal executives Lu Hua and Dan Schatt in late 2017.

Binance Labs is among several investors that have tipped in a total of $300 million USD in lending capital to the Cred project. Leading Malta-based crypto exchange Binance has announced this week, a partnership with Cred to launch a decentralised lending platform for cryptocurrencies with the goal of offering “…open access to credit anywhere and anytime, with the most competitive rates”. Cred will also be migrating some of its native tokens onto the Binance chain. With Binance Lending launching about two months ago and showing significant signs of demand, this partnership makes great strategic sense. Couple that with their margin trade platforms, holding funds against these orders is a must for Binance and consumers are forever seeking out the most competitive rates to sit their HODL bags for the long term.

LIBRA STILL SIGNIFICANT? THE SWEDISH THINK SO…

Cointelegraph report Swedish Riksbank chief Stefan Ingves stating Libra is an “…incredibly important catalytic event”. He explains that it will spur the world’s central banks to prepare themselves for a global digital transformation. The Swedish are already the global leaders when it comes to a “cashless revolution”, with only 2% of all transactions in the country taking place in cash and less than 20% of Swedish stores even accepting cash!

Ingves identifies the importance of this statistic but goes on to clarify that the crypto markets are more than that and pose important questions about ownership, issuance and authority. Ingves believes; “The old issues — private sector money or public sector money — they are basically identical, and if history gives us any guidance at all then almost all private sector initiatives have collapsed sooner or later”

Earlier this year we heard reports that the Peoples Bank of China’s digital currency would soon be ready for launch and just this week, news broke of Canada exploring digital currency alternatives. Couple this with the news that plenty of other retailers are starting to adopt crypto payment platforms and you can see where the future is heading for this space.

SATOSHI. IT’S OFFICIAL

Seven years after its reported first use, satoshi, has officially entered the Oxford English Dictionary.

Defined as;

“The smallest monetary unit in the Bitcoin digital payment system, equal to one hundred millionth of a bitcoin”

It further describes satoshi as a noun, and references Satoshi Nakamoto, as ‘…presumed to be a pseudonym for one or more unknown persons’ to whom the invention of Bitcoin is attributed. pseudonymous’ creator or creators of bitcoin.

In this context, Nakamoto is an etymon, or a word from which a later word is derived.” The entry also references that the person behind Satoshi Nakamoto was presumed born in 1975 based on some of the few clues left behind on the P2P Foundation website where Bitcoin was first publicly referenced.

HAPPY 18 MILLIONTH BIRTHDAY

It’s been a big week for Bitcoin, first its monetary unit is named in the dictionary and now its 18th millionth block will be mined this week! That means that there are only 3 million more Bitcoin to ever be created.

I’ve reported previously that its thought upwards of 30% of the total supply has already been lost and with the halving coming up in May 2020, the commodity that is already scarce will become even more so. Sometime in May next year, the block reward that is distributed to miners will halve from 12.50 bitcoin to 6.25.

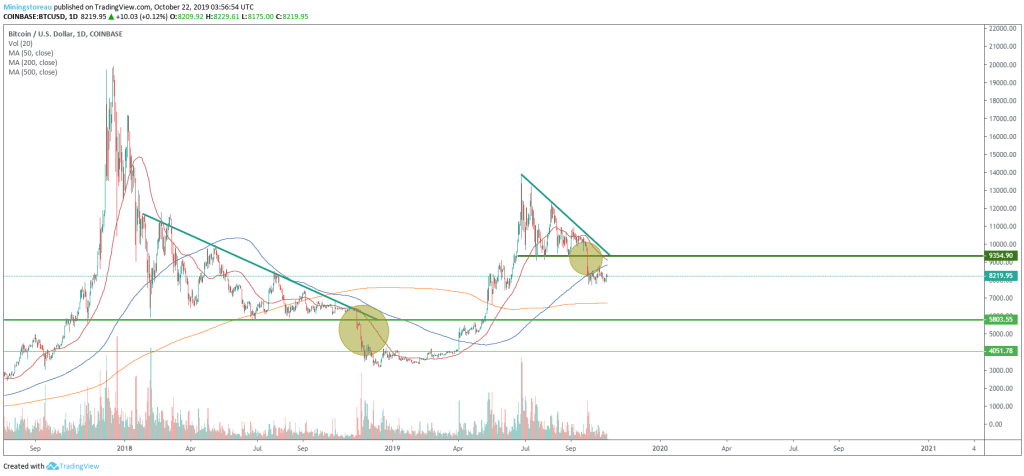

BITCOIN TECHNICAL ANALYSIS

This week we are focusing on three major pieces of technical analysis for Bitcoin.

- As mentioned in last weeks analysis, the looming death cross (50/200 MA cross) is still approaching and it looks like we should see a cross within the next fortnight.

- Bitcoin price still remains below the 50MA line, therefore we are still considered to be in bearish territory.

- A new piece of analysis to take note of. In the chart above you can see two descending triangles charted out. Both of these descending triangles played out like textbook material and we saw the floor of BTC price drop at the pointy end. If we look at how the market recovered from the previous break on the descending wedge, it looks like Bitcoin might be preparing itself for the next leg up.

There is also fundamental support behind a Bitcoin rally.

- The Bitcoin Halving is approaching. MiningStore Co- Founder William Wright made a post on linked-in this week explaining what the halving of Bitcoin means. For those who don’t know what it is, check out the article here.

- Global economy and modern financial systems are under immense pressure. Banks are facing negative interest rates and the global economy is still lacking growth. This is leading to further adoption of the alternative banking system known as cryptocurrency.

Stay tuned for next weeks charting analysis of how the Bitcoin halving has effected Bitcoins price & Blockfi

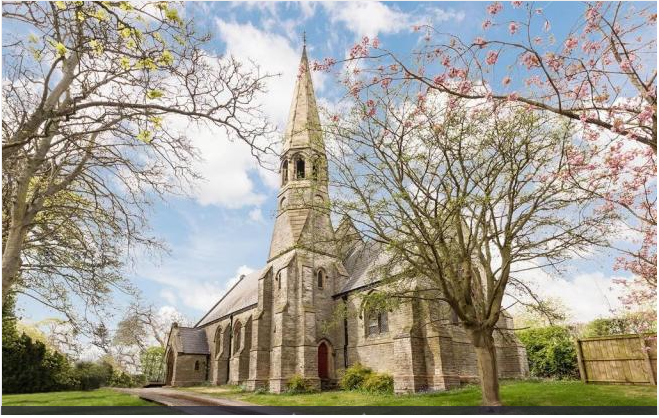

ANYONE FOR A CHURCH? ONLY 150 BTC – MORE OR LESS

A former English church has been put up for sale this week at a modest price of “approximately 150 Bitcoin”. The fully renovated, converted seven bedroom church in the county of Durham England, is listed around £1,200,000 but open to accepting Bitcoin as an accepted means of payment, final amount of Bitcoin to be confirmed on the day of sale and the price agreed upon by the two parties.

Image -> Rightmove.co.uk

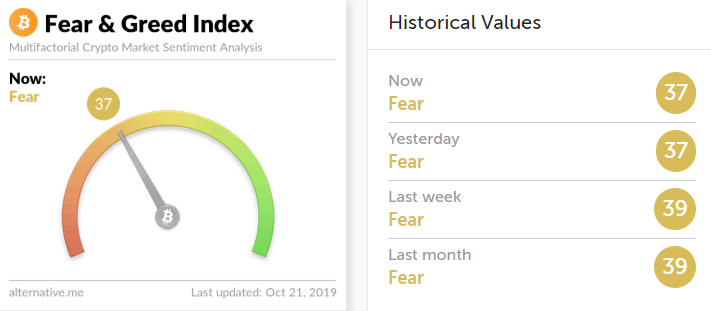

FEAR, GREED AND MENTALITY

The Alternative.me Fear and Greed index has been practically identical these last few weeks, not much new to report here so keep your eyes on it for future change.

Author: Julian Carruthers

Read last week’s crypto rundown here.

Not financial or investment advice, always do your own research.