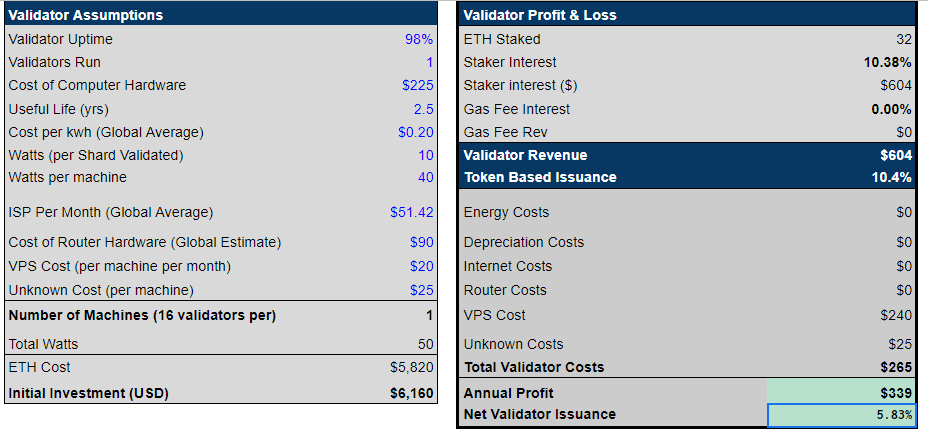

ETH 2.0 STAKING STRUCTURE ROI

ETH 2.0, due out in 2020, brings with it the proof-of-stake switch for the second largest blockchain – Ethereum (ETH). Preliminary numbers show that:

- 32 ETH will be required to be staked (approximately $5,800 USD)

- ETH 2.0 will maintain inflation rates below 1 percent and dynamically adjust rewards scale for validators.

- ROI before costs between 4.6-10.3%

- ROI after costs of around 5.83% (based on Collin Myers numbers)

ETH founder Vitalik Buterin, is still mulling over different ideas for how ETH 2.0 will look, and depending on that outcome, the cost shown above could increase.

At a glance, the above numbers show earning potential of 10% before costs on staking your 32 ETH (or around 5% after costs).

What would your staked coins do for the chain;

“Validators on a proof-of-stake blockchain like Ethereum 2.0 have a similar responsibility to that of miners on a proof-of-work blockchain. These actors on a blockchain serve to process transactions and append new blocks”

And don’t stress if you aren’t part of the tech savvy bunch and don’t have a clue how to set this up yourself. You are not alone! There’s sure to be exchanges and hosting providers that will run these nodes on your behalf… for a fee of course. Regardless of your tech ability you’ll be able to lock your ETH up for long term returns at around 5%. That’s almost sure to be better than any bank would give you.

KEISER ON GOLD BACKED CHINESE CRYPTO

Kitco news had a Halloween special this week with the always animated Bitcoin bull, Max Keiser. Keiser’s biggest claim was that:

“[China] is rolling out a cryptocurrency, a lot of the details have not been divulged. I can tell you that the cryptocurrency that China’s rolling out will be backed by gold. It’s a two-pronged announcement. Number one, China’s got 20,000 tonnes of gold, number two, we’re rolling out a crypto coin backed by gold, and the dollar is toast,”

This week the Fed injected another $100 billion into the repo market and have bought back $7.5 billion in treasury bills with their holdings now totaling over $4 trillion (I talked about the banking liquidity market in newsletter #15 if you want a refresher). If Keiser’s claims turn out to be true, then it’s a fair assumption that this could put a lot of pressure on the precarious position the US banking system finds itself in. The Bitcoinist put it like this:

“China is about to launch a gold-backed cryptocurrency with the intention of destroying the greenback. Gold and bitcoin prices will continue to surge as the dollar collapses to zero like ‘every piece of garbage fiat before it’.” (That inside quote was from Keiser of course!)

CHINA LAUNCHES 25 EDUCATIONAL VIDEOS ON BLOCKCHAIN

It’s been revealed this week by Newslogical that the Publicity Department of the Central Committee of the Communist Party of China (CCPPD) will be releasing a 25 part video series on “basics of Bitcoin, Ethereum, smart contracts, and importantly other basic aspects of blockchain technology.” The videos will also elaborate on “blockchain security, big data, and necessary programming code examples needed to get acquainted with cryptocurrency”.

You’ve got to give it to China. They move fast. A little over a week ago, president Xi Jinping announced his ambitions to move China into the blockchain space – a day later, congress passed the new laws to come into effect on January 1 2020. A week on from that and we have a comprehensive suite of educational videos confirmed for release with the sole purpose of educating the people of China.

The digital Renminbi is soon to be launched and lastly the president Xi Jinping promised to put the country on the blockchain.

SWISS BANKERS SAY ONE THING, DO ANOTHER

Chief strategist and head of research, Christian Gattiker-Ericsson from Swiss banking giant Julius Baer was interviewed this week by Arabian Business. One of his key points was, “We are still in this Darwinian selection process where different business models get tried and tested, but we haven’t seen something that was a clear winner.” As further reported by Cointelegraph, Gattiker-Ericsson added he feels the crypto industry is more like gold than a currency stating “… (innovators would need to be able to) ‘transfer the trust’ that is ‘inherent in a currency, central banks and governments’ — and transpose this into ‘the virtual, decentralized world.’”

Gattiker-Ericsson characterized blockchain technology as a new frontier, saying that Julius Baer was “exploring its possibilities” and acknowledged that it will “possibly change the rules of the game.”

Arabian Business noted this was the same chief strategist that in 2018 likened cryptocurrency investments to gambling and the bank was not advising any clients to purchase or speculate in the field. What a difference 12 months makes, with the bank now actively recommending crypto as an investment option and even announcing a partnership with licensed Swiss bank Seba Crypto.

It’s no secret now that in 2018 when that statement was made, Julius Baer actually owned a minority stake in Seba Crypto. This is just another example of don’t do as they say, do as they do. Watch the money, not public statements.

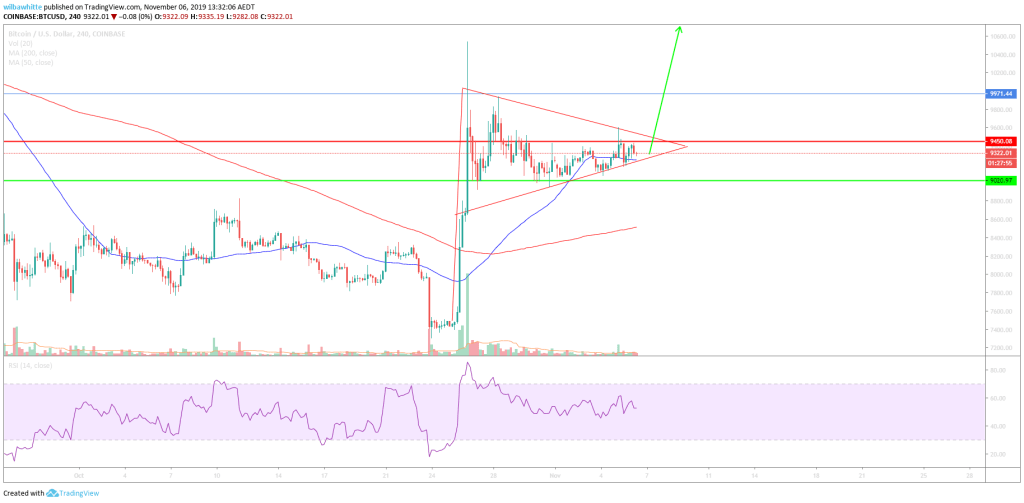

TECHNICAL ANALYSIS

Last week’s announcement by President Xi of China sent BTC/USD price soaring back towards the $10,000 USD range. This week BTC has entered into a price range of $9000-9450.

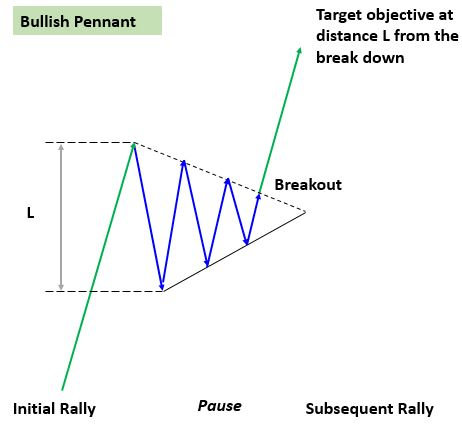

For those who believe in traditional technical analysis, there is a clear bullish pennant being formed at the moment which could lead to a bullish breakout.

See the images below for a demonstration of what a bullish pennant looks like.

The chatter within trading groups including the Mining Store Discord is very bullish at the moment. It is also worth noting that around this time of year was when the 2017 bull run really kicked off.

BITMEX COMPROMISES USER EMAILS

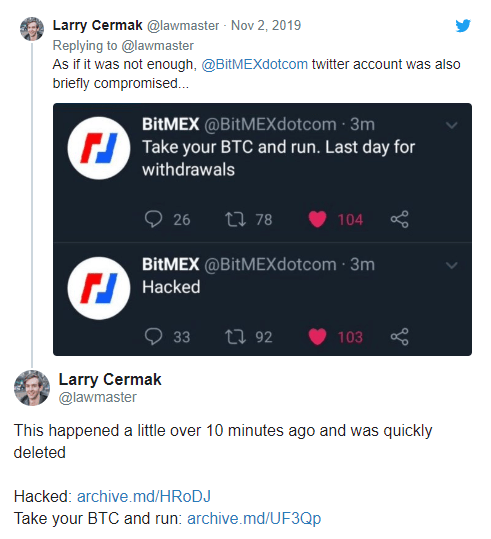

A massive blunder this week at BitMEX exchange has seen many of its users’ emails revealed to the world. BitMex made the rookie error via broad distribution of an automated user update email which contained user emails in the cc field.

It’s believed the emails were shown in blocks of 1,000 per email, but the exact details remain unknown, it’s rumoured to be 20,000+ users. Basically, anyone with an email address registered to BitMEX is now open knowledge and this could be seen as pretty attractive bait to hackers and scammers. Be careful out there.

If that wasn’t bad enough, on the same day this blunder occurred, the BitMEX twitter account was briefly hacked. Two unauthorised tweets were published before being swiftly deleted 10 minutes after posting. This raises some red flags about BitMEX security.

STARBUCKS TO ACCEPT BAKKT MERCHANT SERVICE

Long-time advocates of Bitcoin, Starbucks announced earlier this year they’d be accepting Bitcoin payments. Extending this support further, they announced this week, they’d also be accepting Bitcoin payments through the Bakkt merchant portal.

Bakkt has been testing and developing their portal and believe it will be ready for launch in July next year. With over 30,000 outlets globally, consider for a second the reach this partnerships will have and the work Bakkt are doing for the cryptocurrency space.

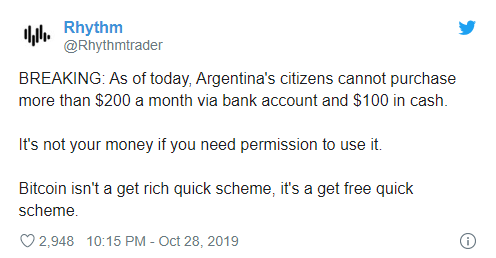

ARGENTINA RESTRICTS ITS CITIZENS – USD

How would you feel if you woke up one morning and your government told you how much you could buy of something in any given week? Well the Central Bank of Argentina has done just that. They have restricted all citizen purchases of US Dollars. The limit set is no more than $200 USD per month through their bank account and $100 USD if paying in cash. Why? Because the Argentine Peso has been rapidly devaluing. In September the initial restrictions put in place were $10,000 USD per month.

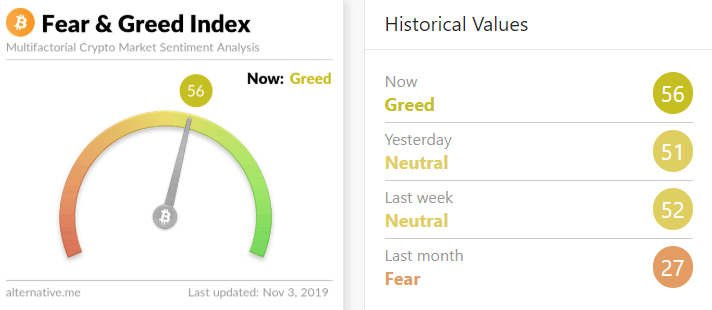

FEAR, GREED AND MENTALITY

Alternative.me Fear and Greed index is steady at 56 – slight Greed. I would feel more comfortable with a neutral reading, as the market and Crypto Twitter has mixed opinions on where the price of Bitcoin heads next. If you were a buyer when the index was in fear last month you’re probably sitting in a profitable position right now. If you are concerned, like me, about missing the next big run then now is the time to settle on your stop losses. Write down your trading strategy for the next few months and ride it out.

Keep in mind that any move upwards on Bitcoin price will also inflate the USD value of most alt coins. What it will present, however, is a drop in the Bitcoin Satoshi value of these alt coins, meaning an increase in Bitcoin could provide buying opportunities for your favourite alt coins. So if you are not fully invested or you have your eyes on some coins, ensure you have your buy orders placed on exchange so you don’t miss any quick candles in your favour.

Author: Julian Carruthers

Not financial or investment advice, always do your own research.