Starting June 1, the Federal Reserve will begin draining that plus $3.3 trillion of bank reserves from its nearly $9 trillion balance sheet to put all of this money in motion — a process it called “quantitative tightening”.

Quantitative tightening, also known as balance sheet normalisation, is a type of monetary policy followed by central banks. It simply means that a central bank reduces the pace of reinvestment of proceeds from maturing government bonds, and is the exact opposite as the monetary stance of quantitative easing. Quantitative tightening also means that the central bank may increase interest rates as a tool to curb the money supply in the economy.

And it may turn out to be anything but as dull as “watching paint dry,” as Janet Yellen described it when she was Fed chair in 2017 — the last time when the central bank initiated a similar process.

President Joe Biden met with Federal Reserve Chairman Jerome Powell Tuesday afternoon to address inflation, the topic at the forefront of many investors’ minds.

“I don’t think we know the impacts of QT just yet, especially since we haven’t done this slimming down of the balance sheet much in history,” said Dan Eye, chief investment officer of Pittsburgh-based Fort Pitt Capital Group. ”But it’s a safe bet to say that it pulls liquidity out of the market, and it’s reasonable to think that as liquidity is pulled out, it affects multiples in valuations to some degree.”

While the precise impact of quantitative tightening in financial markets is still up for debate, analysts at the Wells Fargo Investment Institute and Capital Economics agree that it’s likely to produce another headwind for stocks. And that’s an issue for investors facing multiple risks to their portfolios for the time being, as government bonds sold off and stocks nursed losses on Tuesday.

“Quantitative tightening may add to upward pressure on real yields,” the institute said. “Along with other forms of tightening in financial conditions, this represents a further headwind for risk assets.”

Andrew Hunter, a senior U.S. economist at Capital Economics stated that “The main impact will come indirectly via the effects on financial conditions, with QT putting upward pressure on Treasury term premiums which, alongside a further slowdown in economic growth, will add to the headwinds facing the stock market,”

So how will this impact the cryptocurrency market?

We’ve learned that as the year progresses and the longevity of Bitcoin and cryptocurrencies continues to grow that the wider macroeconomic situation globally is having profound impacts.

Pav Hundal, manager at the Australian crypto exchange Swyftx, believes that QT could have a negative impact on markets. He told Cointelegraph on Wednesday that “it’s very possible that you might just see growth in market cap trimmed slightly:”

“The Fed is culling assets harder and faster than a lot of analysts had expected and it’s difficult to imagine that this won’t have some kind of impact on investor sentiment across markets.”

In contrast, financial advisory firm deVere Group CEO Nigel Green believes market reactions to QT will be minimal because “it’s already priced in.” Green said there may be a “knee-jerk reaction from the markets” because of the unexpected speed with which QT is being rolled out, but he sees it as a little more than a wobble:

“Furthermore, we expect a market bounce imminently, meaning investors should be positioning portfolios to capitalise on this.”

The narrative behind this sentiment is that as financial markets globally are experiencing a serious downturn with high volatility, Bitcoin could benefit through demonstrating its position as a safe haven asset for investors.

The Economiser has noted that Bitcoin dominance is currently at about 47%, up by eight percentage points from the start of 2022. “There are different ways to interpret this,” adding:

“It does suggest that market participants are seeking to park value in Bitcoin, meaning we could see weakness continue to trend across alt coin markets if current market conditions continue to play out.”

It will be interesting to see the path Bitcoin (and the wider cryptocurrency market) follows after factoring in quantitative easing and further interest rates hike, in hopes of a slowed economy and inflation.

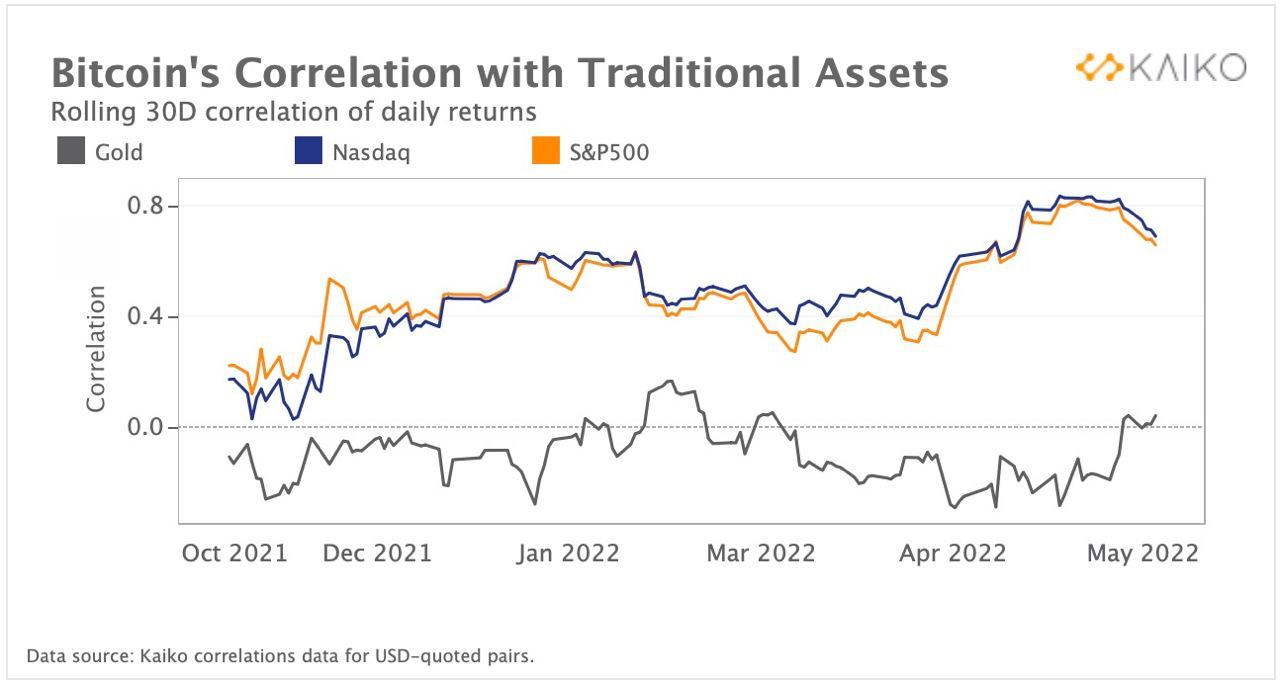

The correlation coefficient between BTC and the Nasdaq has hit all time highs in 2022, so a decoupling would be required to survive any further stock market downturns, with investors seeking to park value in Bitcoin.

However, in recent weeks, Bitcoin’s correlation with equities has decreased drastically, increasing considerably with Gold. This looks like a trend that could potentially continue for the next couple of weeks and could determine the long term structure of the market.

It is evident that regardless of the direction the cryptocurrency market moves, quantitative tightening by the U.S. Federal Reserve will have a serious impact on general traditional sentiment across the cryptocurrency market.